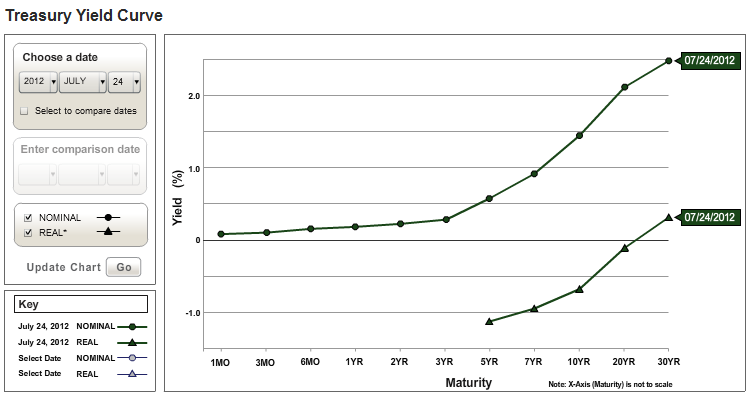

[DRAFT] Carpe Diem posted the following chart, which I’ve seen elsewhere. I find it interesting because of the strong rightward lean of that blog. So,Read More

Uncertainty vs Uncertainty

[DRAFT] “Uncertainty” plays a major role in the debate about what ails the US economy. Conservative bloggers, columnists and economists tend to emphasize the roleRead More